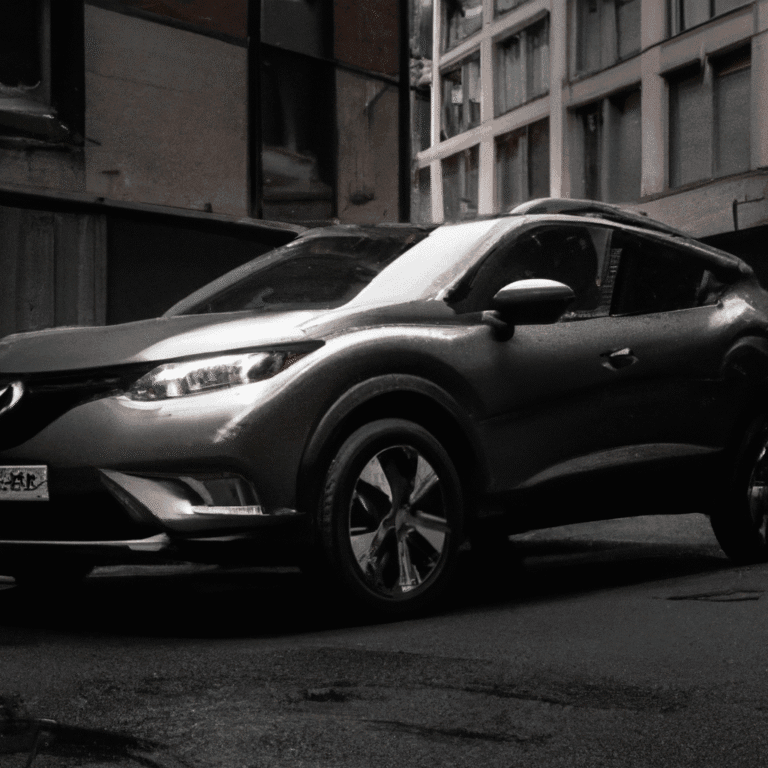

The estimated cash value of the Nissan Qashqai 2015 is approximately £10,500 in the United Kingdom. According to simulations, payments could start from £22 per payment. This makes the Qashqai an attractive option for those looking to blend style, comfort, and practicality without breaking the bank.

💰 Financing simulations for Qashqai 2015

| Term | Without interest | With interest (8.5% annual) |

|---|---|---|

| 48 months | £ 219 | £ 259 |

| 60 months | £ 175 | £ 215 |

| 120 months | £ 88 | £ 130 |

🚗 Is it possible to finance no deposit in United Kingdom?

Absolutely! Financing the Nissan Qashqai 2015 at NatWest can be done with no deposit required. This means you can drive away in your new vehicle without having to put any money down upfront. This flexibility is particularly beneficial for those who may not have the means to make a large initial payment.

📊 Leasing with Weekly Payments

If you prefer leasing, several companies offer competitive plans. Companies like Arval UK, Alphabet GB, Close Brothers, Black Horse, and Santander Consumer Finance provide leasing options with weekly payments starting at approximately £22. This could be a great way to keep your monthly budget manageable while enjoying the benefits of a modern vehicle.

🏦 About NatWest in United Kingdom

When considering financing options for your Qashqai, it’s crucial to know your lender. NatWest has a strong reputation in the UK for providing various financial services, including car financing. Their customer service and tailored options make them a popular choice among car buyers.

🔍 Analysis of the Qashqai 2015

The Nissan Qashqai 2015 is highly regarded for its blend of practicality and style. It boasts a spacious interior, advanced safety features, and impressive fuel efficiency. With a comfortable ride and good visibility, it’s ideal for both city driving and long journeys. Plus, its modern design and tech-savvy features, including a user-friendly infotainment system, keep it competitive in today’s market.

💡 Financing alternatives

If you’re exploring financing options, consider a few alternatives that could suit your needs. Peer-to-peer lending platforms might offer competitive rates, while credit unions often have lower interest rates compared to traditional banks. Additionally, you might want to check if any promotions or partnerships are available, as these can lead to better financing terms. Always compare offers, and don’t hesitate to negotiate the terms with lenders to get the best deal.

Want to know how to finance a car no deposit and no credit check? See how to buy a car no deposit and no credit check

📱 Would you like to stay informed? Join our WhatsApp group

*The figures displayed here are for reference and educational purposes only. Actual payments will vary based on the financed amount, the chosen bank, repayment terms, your credit rating, and other conditions. We do not guarantee eligibility criteria. Contact the financial institution for current and specific information.*