The estimated cash value of the Maruti Ertiga 2012 in India is approximately ₹ 450,000. According to simulations, payments could start from ₹ 938 per payment, making it a feasible option for many potential buyers looking for an affordable family car.

💰 Financing simulations for Ertiga 2012

| Term | Without interest | With interest (13.3% annual) |

|---|---|---|

| 48 months | ₹ 9,375 | ₹ 12,139 |

| 60 months | ₹ 7,500 | ₹ 10,308 |

| 120 months | ₹ 3,750 | ₹ 6,799 |

🚗 Is it possible to finance zero down payment in India?

Absolutely! Financing the Maruti Ertiga 2012 at the Central Bank of India allows for a zero down payment option. This feature is particularly appealing for first-time buyers or those who prefer to keep their savings intact while making a significant purchase. The absence of a down payment can make the process less daunting and more accessible.

📊 Leasing with Weekly Payments

Leasing companies like Maruti Finance, Tata Motors Finance, Mahindra Finance, HDFC Credila, and Bajaj Finance offer plans that enable you to manage your payments effectively. With weekly payments of approximately ₹ 938, this option helps to ease the financial burden by spreading out the costs, making it easier to budget without compromising on your vehicle choice.

🏦 About Central Bank of India in India

For those considering financing, the Central Bank of India is a reliable option, known for its customer-centric services. They provide various financial solutions tailored to meet the diverse needs of their clients, making car financing a straightforward process.

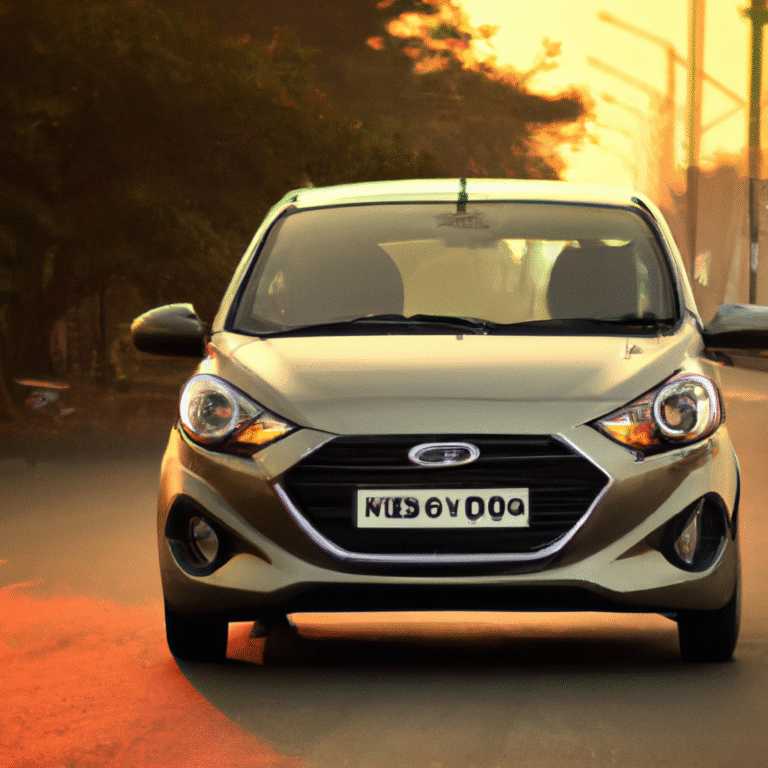

🔍 Analysis of the Ertiga 2012

The Maruti Ertiga 2012 stands out for its spacious interior and family-friendly design. With seating for seven, it’s perfect for larger families or those who appreciate extra space. Its fuel efficiency, combined with manageable maintenance costs, further enhances its appeal. The model is equipped with modern features that ensure a comfortable driving experience, while its robust performance on the road guarantees reliability.

💡 Financing alternatives

While financing through the Central Bank of India is a fantastic option, don’t forget that there are other financing alternatives out there. Explore options from different banks and financial institutions to compare interest rates and terms. Additionally, consider applying for government schemes that promote vehicle ownership or check for promotional offers from dealerships, which might include cash discounts or loyalty benefits.

Want to know how to finance a car zero down payment and without CIBIL check? See how to buy a car zero down payment and without CIBIL check

📱 Would you like to stay informed? Join our WhatsApp group

*The economic data presented is estimated and purely informational. Final installments are subject to the loan amount, the credit organization, the payment period, your financial assessment, and multiple factors. We do not guarantee acceptance requirements. Contact the institution for accurate and adjusted information.*