The estimated cash value of the Maruti Dzire 2011 is approximately ₹ 350,000 in India. If you’re eyeing this compact sedan, according to simulations, payments could start from ₹ 729 weekly. This makes the Dzire an accessible choice for many, especially with the financing options available at IndusInd Bank.

💰 Financing simulations for Dzire 2011

| Term | Without interest | With interest (13.3% annual) |

|---|---|---|

| 48 months | ₹ 7,292 | ₹ 9,442 |

| 60 months | ₹ 5,833 | ₹ 8,017 |

| 120 months | ₹ 2,917 | ₹ 5,288 |

🚗 Is it possible to finance zero down payment in India?

Absolutely! One of the standout features of financing a Maruti Dzire at IndusInd Bank is the option for zero down payment. This means you can drive off in your new vehicle without spending a single rupee upfront, making it easier for first-time buyers or those on a tight budget to own a car. This financing flexibility allows for greater financial planning and control, especially when coupled with the bank’s range of tailored solutions.

📊 Leasing with Weekly Payments

When it comes to leasing, companies like Maruti Finance, Tata Motors Finance, Mahindra Finance, HDFC Credila, and Bajaj Finance are key players in the market. They offer competitive plans that allow for weekly payments of approximately ₹ 729. This structure can be particularly beneficial for those who prefer shorter payment cycles, helping manage cash flow more effectively.

🏦 About IndusInd Bank in India

If you’re considering financing through IndusInd Bank, you’re in good hands. Established with a vision to cater to a diverse customer base, IndusInd Bank offers a variety of financial products, making it a popular choice for auto loans. Their services are designed to be customer-centric, often incorporating flexible terms to suit individual needs.

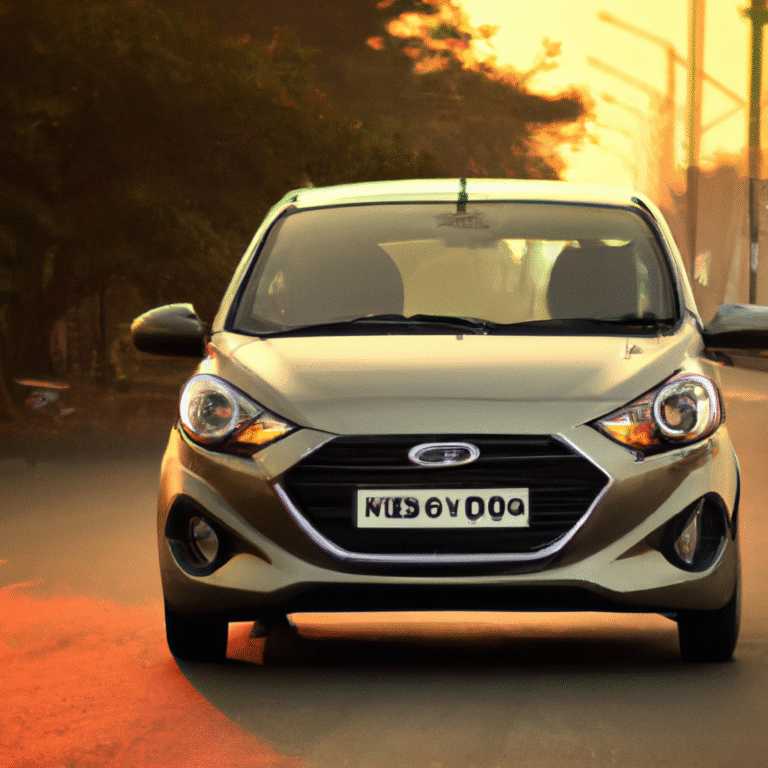

🔍 Analysis of the Dzire 2011

The Maruti Dzire 2011 is a compact sedan known for its reliability and fuel efficiency. With a spacious interior and a decent boot space, it caters to urban families and professionals alike. The Dzire is also celebrated for its low maintenance costs and resale value, which makes it a practical option for those looking to balance functionality with affordability. Its smooth handling and compact size make it well-suited for navigating crowded city streets.

💡 Financing alternatives

If you’re exploring your options, consider other financing avenues as well. Look into government schemes that promote electric or hybrid vehicles, which may offer subsidies. Additionally, researching credit unions or local banks can uncover competitive interest rates. Always check the fine print to understand any additional fees that may apply. Consulting with a financial advisor can also help you make the best choice tailored to your financial situation.

Want to know how to finance a car zero down payment and without CIBIL check? See how to buy a car zero down payment and without CIBIL check

📱 Would you like to stay informed? Join our WhatsApp group

*The economic data presented is estimated and purely informational. Final installments are subject to the loan amount, the credit organization, the payment period, your financial assessment, and multiple factors. We do not guarantee acceptance requirements. Contact the institution for accurate and adjusted information.*