The estimated cash value of the Mini Cooper 2002 is approximately £2,500 in the United Kingdom. According to simulations, payments could start from just £5 per payment, making this stylish and compact vehicle an appealing option for many drivers.

💰 Financing simulations for Cooper 2002

| Term | Without interest | With interest (8.5% annual) |

|---|---|---|

| 48 months | £ 52 | £ 62 |

| 60 months | £ 42 | £ 51 |

| 120 months | £ 21 | £ 31 |

🚗 Is it possible to finance no deposit in United Kingdom?

Yes, financing a Mini Cooper 2002 with no deposit is indeed possible in the UK. This option means you can drive away your Mini without having to make any upfront payments. This flexibility is particularly beneficial for first-time buyers or those who may not have significant savings available.

📊 Leasing with Weekly Payments

If you’re considering leasing, several reputable companies offer plans that allow for weekly payments of approximately £5. Companies like Arval UK, Alphabet GB, Close Brothers, Black Horse, and Santander Consumer Finance present various leasing options. This can provide a more manageable approach to financing your Mini Cooper while enjoying the benefits of a new vehicle without the long-term commitment of ownership.

🏦 About Barclays in United Kingdom

For financing options, Barclays is a well-established bank in the UK that can help you navigate your car financing needs. They are known for their customer-friendly policies and a variety of financial products tailored to suit different buyer requirements.

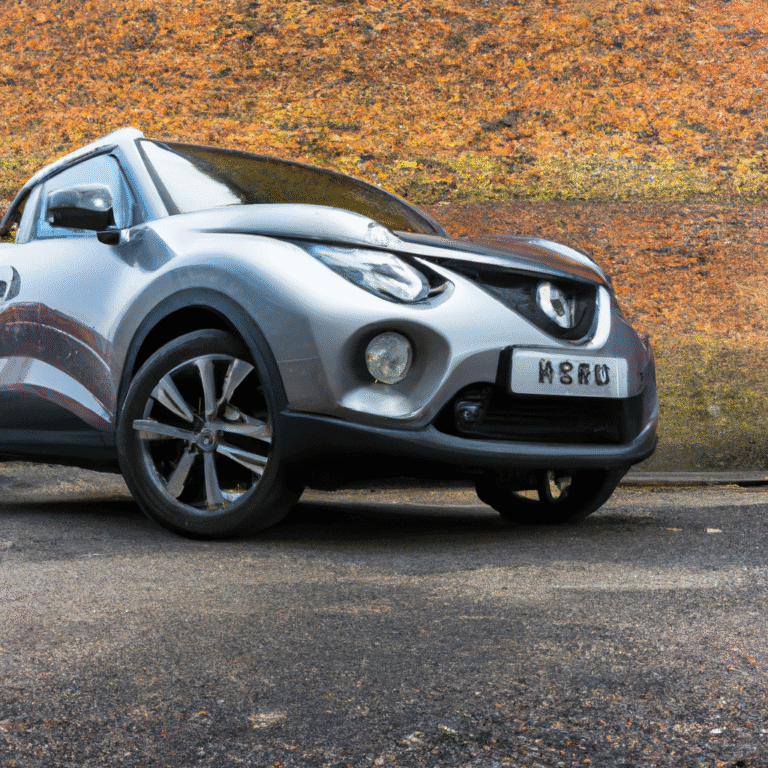

🔍 Analysis of the Cooper 2002

The Mini Cooper 2002 is not just a car; it’s a symbol of quirky British style and a love for driving. With a peppy engine and tight handling, it’s perfect for zipping around urban environments. Additionally, the Cooper’s compact size makes parking a breeze, while its retro design turns heads wherever you go. The vehicle is also known for its fun driving experience, offering a mix of performance and efficiency that appeals to many drivers. Plus, with its relatively affordable price point, it stands out as a practical choice for individuals looking for something unique.

💡 Financing alternatives

When considering financing, think outside the box. Apart from traditional loans or leasing, consider options like personal contract purchases (PCP) which can give you the flexibility of lower payments with the option to buy at the end. Additionally, explore peer-to-peer lending platforms that could offer competitive rates. It’s also a good idea to shop around and compare financial products from different lenders to ensure you are getting the best deal for your situation.

Want to know how to finance a car no deposit and no credit check? See how to buy a car no deposit and no credit check

📱 Would you like to stay informed? Join our WhatsApp group

*The figures displayed here are for reference and educational purposes only. Actual payments will vary based on the financed amount, the chosen bank, repayment terms, your credit rating, and other conditions. We do not guarantee eligibility criteria. Contact the financial institution for current and specific information.*