The estimated cash value of the Honda City 2021 in the Philippines is approximately ₱ 800,000. Excitingly, according to simulations, payments could start from ₱ 1,667 per week, making this stylish sedan more accessible than ever!

💰 Financing simulations for City 2021

| Term | Without interest | With interest (10.5% annual) |

|---|---|---|

| 48 months | ₱ 16,667 | ₱ 20,463 |

| 60 months | ₱ 13,333 | ₱ 17,175 |

| 120 months | ₱ 6,667 | ₱ 10,772 |

🚗 Is it possible to finance no down payment in Philippines?

Yes, financing a car with no down payment is indeed possible in the Philippines, especially with financial institutions like PSBank. This unique offer allows individuals to drive away in their dream car without the burden of an initial payment. It’s a fantastic option for those looking to manage their finances more flexibly.

📊 Leasing with Weekly Payments

Another option to consider is leasing, which can also come with weekly payments. Companies such as Toyota Financial Services, BPI Auto Leasing, Orix Metro Leasing, BDO Leasing, and First Metro Asset Management provide various plans that fit different budgets. With payments approximately at ₱ 1,667 per week, leasing can be an attractive alternative for those who prefer not to commit to long-term financing.

🏦 About PSBank in Philippines

For those interested in financing options, PSBank stands out as a reliable partner. Known for its flexible terms and customer-oriented approach, it has become a popular choice for auto financing in the country. Their offerings, especially related to no credit investigation, make it easier for many Filipinos to acquire the vehicle of their choice.

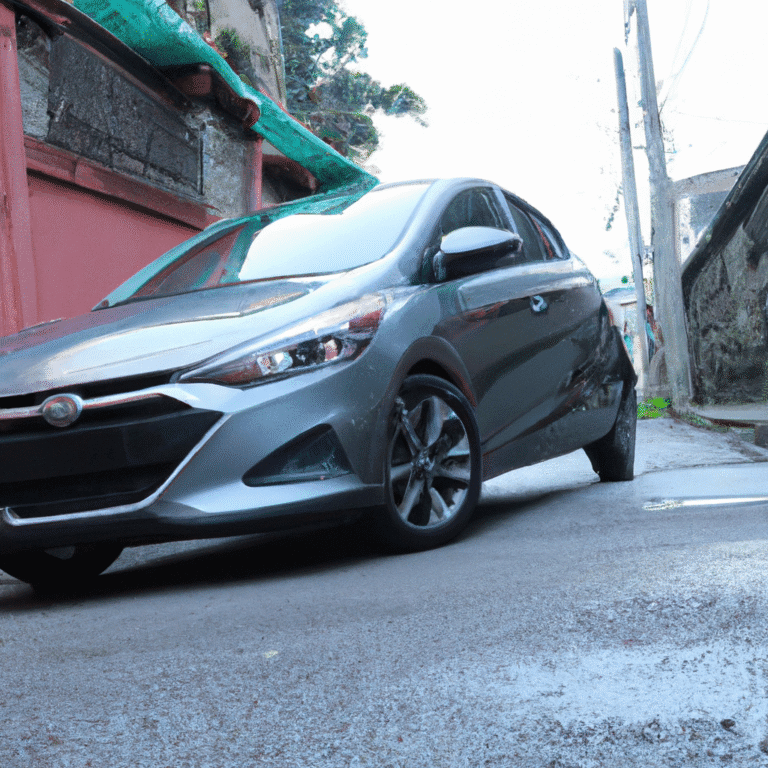

🔍 Analysis of the City 2021

The Honda City 2021 is not just a car; it’s a statement. With its sleek design, modern technology, and impressive fuel efficiency, it’s suitable for both urban commuting and long drives. Features like a spacious interior, advanced safety systems, and connectivity options such as Apple CarPlay and Android Auto make it a popular choice among Filipino drivers. Additionally, its competitive pricing and low maintenance costs add to its appeal, making it a smart investment.

💡 Financing alternatives

If you’re looking for alternatives to traditional financing, consider exploring personal loans or peer-to-peer lending platforms. They may offer better interest rates or terms that fit your needs. Additionally, getting pre-approval can give you a stronger negotiating position when you decide on the final deal. Don’t forget to check out promotional events or partnerships that banks might have with car dealerships, which can provide excellent financing offers or discounts.

Want to know how to finance a car no down payment and no credit investigation? See how to buy a car no down payment and no credit investigation

📱 Would you like to stay informed? Join our WhatsApp group

*The values presented in this article are approximate and for informational purposes only. Installments may vary depending on the financed amount, the financial institution, the term, the applicant’s credit profile, and other factors. This site does not guarantee approval conditions. Always consult with the financial institution for updated and personalized information.*