The estimated cash value of the Maruti Alto 2022 is approximately ₹ 350,000 in India. According to simulations, payments could start from ₹ 729 per payment. This affordable hatchback is not just a popular choice among Indian consumers but also an attractive option for those looking to finance their vehicle with flexible terms.

💰 Financing simulations for Alto 2022

| Term | Without interest | With interest (13.3% annual) |

|---|---|---|

| 48 months | ₹ 7,292 | ₹ 9,442 |

| 60 months | ₹ 5,833 | ₹ 8,017 |

| 120 months | ₹ 2,917 | ₹ 5,288 |

🚗 Is it possible to finance zero down payment in India?

Yes, financing with zero down payment is indeed possible in India. This means that you can drive away in your new Maruti Alto 2022 without having to put any money down upfront. This is especially helpful for first-time car buyers or those who prefer to allocate their funds elsewhere.

📊 Leasing with Weekly Payments

Several leasing companies such as Maruti Finance, Tata Motors Finance, Mahindra Finance, HDFC Credila, and Bajaj Finance offer attractive financing options. They provide plans where payments can be made with **weekly payments** of approximately ₹ 729. This flexibility allows buyers to manage their cash flow better, making it easier to afford their new vehicle without stretching their budget too much.

🏦 About State Bank of India in India

For those considering financing options, State Bank of India is a reliable choice. With a vast network across the nation, SBI offers competitive rates and a range of loan products tailored to meet customer needs. Their streamlined process means you could be behind the wheel sooner than you think!

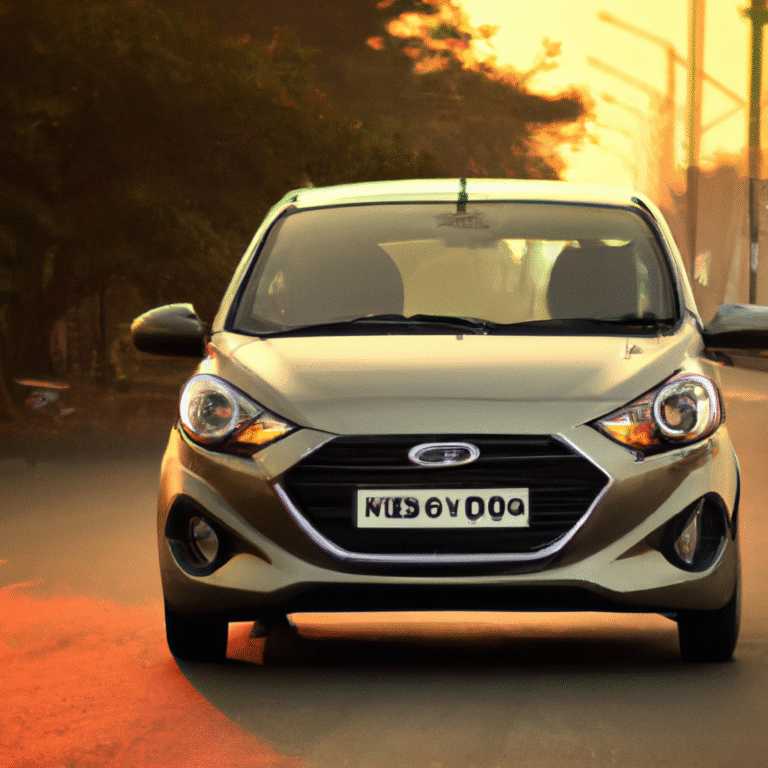

🔍 Analysis of the Alto 2022

The Maruti Alto 2022 is not just about affordability; it’s also known for its fuel efficiency, compact size, and ease of handling. Ideal for both city driving and longer journeys, it offers a spacious interior despite its small footprint. The model comes equipped with modern features, including enhanced safety options and infotainment systems that appeal to tech-savvy drivers. Its reputation for reliability makes it a go-to vehicle for many Indian families.

💡 Financing alternatives

When considering alternatives for financing, it’s wise to shop around. Don’t just settle for the first offer that comes your way. Take the time to compare interest rates, terms, and conditions from various lenders. Some tips include checking for promotional deals, considering a co-applicant, or finding out if your employer has any special financing relations with banks. Additionally, making a higher down payment, if possible, can substantially lower your monthly installments in the long run.

Want to know how to finance a car zero down payment and without CIBIL check? See how to buy a car zero down payment and without CIBIL check

📱 Would you like to stay informed? Join our WhatsApp group

*The amounts shown are estimates for guidance purposes. Actual installments will depend on the requested capital, the banking institution, the repayment period, credit history, and other variables. This page does not guarantee credit approval. Verify directly with the bank for precise and tailored data.*